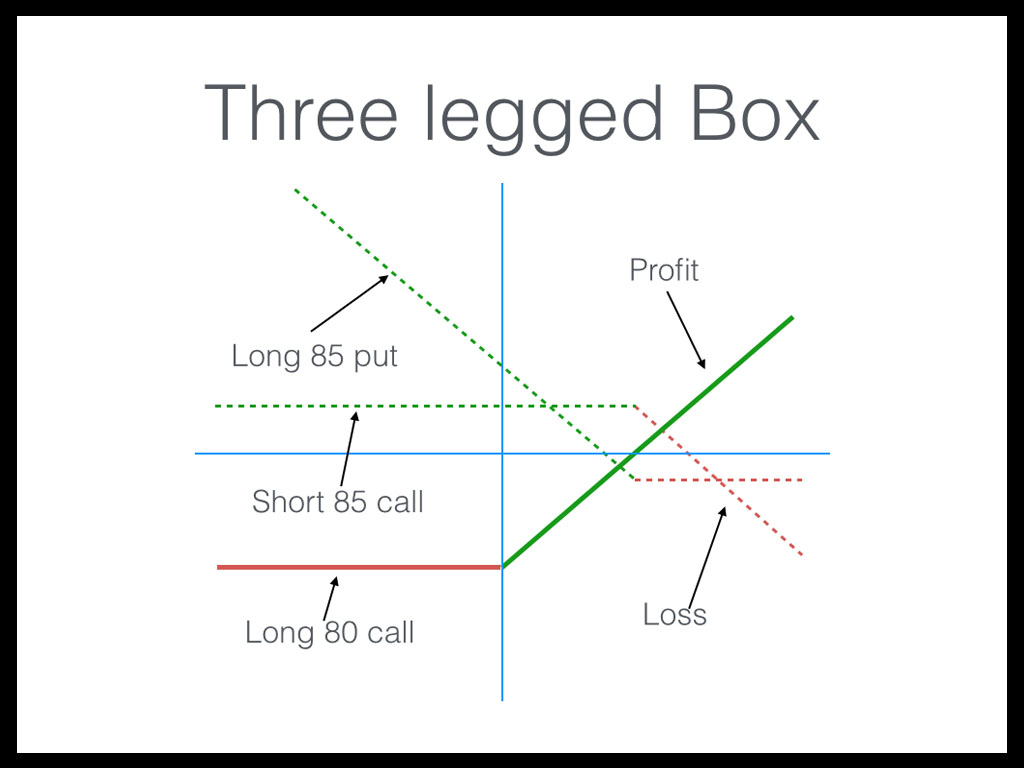

A three-leg box is simply a four-leg box amputee. One of the pieces of a traditional box has not been traded for a variety of possible reasons. Not selling one of the options (that should traditionally be sold) to increase potential profit, or not buying a leg that should be bought to increase possible profit while incurring more risk are the two primary reasons to be in a three-leg box.

Using the Three Leg Box Techniques

The use of the three-leg box technique depends heavily on a solid understanding of the six basic synthetics and the standard box. Let’s consider what it takes to construct a three-leg box using the 195 and 200 strikes in AAPL.

The which you DO NOT sell is what you have synthetically bought

The which you DO NOT sell is what you have synthetically bought

Think of a position as:

Which is identical to having a long 195 put since a 195/200 box is an insert position

Our position now mirrors a long 195 put since we omitted to sell the real 195 put to complete the box. There are plenty of reasons why we may decide against selling the real 195 put.

First, try to get some sense of fair value in the 195/200 call spread by taking the asking price of the 195 and 200 calls. We would assume that the call spread was fairly priced around $13.60 – $8.75 = $4.85. That being the case, the 200/195 put spread is fairly valued at $0.15. If so, then paying $0.21 for the 200 puts would leave us synthetically long the 195 puts for $0.06 – the bid price of those options. Because we are synthetically long the option on the bid, and because the bid is only 6 cents, we may think we need to complete the box.

Furthermore, due to some traders’ commission schedules or fee schedules, selling an option for around 6 cents may become prohibitive. In fact, some traders won’t sell an option that is trading for 10 cents or less on sheer principle. That being the case, sometimes a trader has no choice but to enter into a three-leg box position.

As we progressed through the lesson, we learned how to make use of three-leg box techniques to close out ratio spread or BWB positions. To review, let’s take a closer look at both the call and put BWBs from the webinar.

For the Call BWB:

- We could BUY the 210/200 2 x 1 ratio spread for 2 x $1.60 – $0.07 = $3.13 debit. But at expiration, you would be short twice as much stock at the 210 strikes as you would be long stock at the 200 strike. So you would need to buy 100 shares of AAPL per BWB contract.

- You could pre-sell AAP: stock at $209.30 which would close out the risk in the long 200 calls and but back the real 210 calls for %0.88 each.The reason would not proceed to box out the trade using the puts is that it would put you in the same position as #1, and with AAPL near $210 on expiration Friday, yuou would be sujecting yourself to Pin Risk!

In most cases, you could simply box out the trade. However, pin risk may become a factor in our example so we can thoroughly illustrate how to exit the position.

Notice a key difference between the thoughts of a standard retailer and a professional trader. A typical retail trader thinks in terms of calls and puts. A typical professional thinks in terms of “lines,” or strikes. In other words, we think in terms of how many units we are net long or short in a particular strike. It does not matter whether they are calls or puts because we can always buy or sell stock to correct for the leftover delta risk after boxing off positions. For example, pre-selling the stock in the case of the Call BWB takes care of any concerns we had at the 200 strike AND leaves us open-ended should the stock suddenly drop to near or below $200 prior to expiration. The 230 calls are not a concern since (a) we are long them and (b) they are worthless. The only remaining issue is with the 210 calls that we are short.

We could buy the 210 puts and stock to synthetically close out the risk on the position; however, that would mean an additional set of transactions (for the stock) which would leave us with the pin risk concern. Therefore, in this case, the better answer is the simpler one – just buy back the original 210 calls that we sold out.

For the Put BWB, the process is only slightly different.

- We could BUY the 210/220 2 x 1 ratio spread for 2$0.88 – 0.04 = $1.72 debit. BUT at expiration, you would be long twice as much stock at the 210 strike as you would be short stock at the 220 strike. So you would need to sell 100 shares of AAPL per BWB contract.

- You could pre-buy AAPL stock at $209.30 which would close out the risk in the long 220 puts and buy back the real 210 puts for $1.60 each. The reason you would not proceed to box out the trade using the calls is that it would put you in the same position s #1, AND with AAP: near $210 on expiration Friday, you would be subjecting yourself to Pin Risk!

Remember that we are showing a technique as an exit strategy. As we stated in the Level 2 – Option Trading Guide to Broken Wing Butterfly (BWB) e-book, the reality is that BWBs are best placed in indexes. Since the major indexes like the SPX and the NDX are cash settled, the pin risk is eliminated, but only if you completed a box or a 3 leg box position. When exiting a BWB trade, it does open us up to a synthetic long or short stock position that may cash settle for or against us.

Since the SPX and NDX (among others) index, you cannot own a tangible piece of the index. Unless you want to buy or sell index futures as a hedge, getting rid of the extra long or short stock risk may prove quite complicated. Later in the course, we will introduce the roll as a standard technique for dealing with leftover synthetic stock positions in a given month. However, even the roll does not make the position go away; instead, it just puts the problem “on hold” for another month.

We could place these trades on ETFs so that there is a tangible product to buy or sell. Although products like the SPYs, QQQQs, and DIAs give us the benefit of an index with a tangible underlying, they are also we have to recognize pin risk again because they are an American exercise. We are merely making you aware of all considerations.

Option Trading Newsletter: July 29, 2016

Today Today’s Events GDP – [...]

Option Trading Newsletter: July 28, 2016

Today Today’s Events International Trade of [...]