Introduction

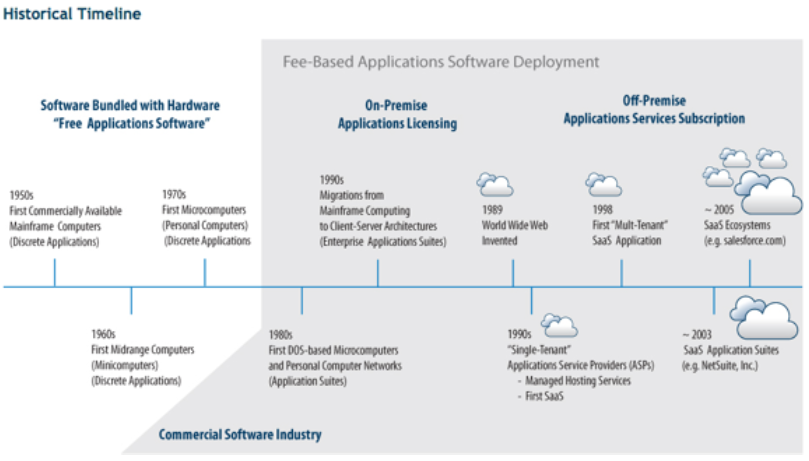

About a decade ago we saw the trend that computer software and storage were moving to the “Cloud.”

Microsoft offers office 365 instead of software that stays in the laptop and the suite of all the things in the Cloud named Outlook, which combines email, mobile number, skype, etc. APPLE’s ICloud is a similar service to Microsoft outlook. Dropbox has been popular for file sharing on the Clouds instead of using VPN to access to the shared files. The migration of the data to the internet is the result of faster internet speed.

The Internet changed many aspects of our lives. With high-speed Internet, we can use streaming movie with Netflix, multiplayer video game, home security camera , smartphone apps which does banking, music store, online shopping, etc.

Cryptocurrency is like an internet of money. We are still at the stage when people were afraid to use online shopping or AMAZON when the internet was a new thing.

There is mixed opinion on Bitcoin, which is the first generation cryptocurrency.

Famous economist Nouriel Roubini said in 2018 that he thinks the price of Bitcoin is going to zero.

Venture capitalist Tim Draper predicted that Bitcoin price to go up to $250,000 by 2023.

Which opinion is correct? Well, we will know the truth in a few years.

Because you are reading this book, you must be thinking there is a chance that bitcoin may be the next currency.

Our thought was to allocate a small portion of the portfolio to crypto when we published crypto book in mid 2018.

We thought buying bitcoin in 2018 would be like betting on the next Amazon or Apple stock in the early stage. Bitcoin is very volatile, so some people who bought bitcoin at around $15,000 are not happy, and some bought it in $3,000 are satisfied with the current price around $9,000. We should look at what is happening to the financial world regardless of the price of bitcoin.

The majority of people heard of “bitcoin” as in December 2017 bitcoin hit close to $20,000. However, mainstream brokerage was not dealing with Bitcoin or Altcoins (cryptocurrencies or tokens other than Bitcoin are called “Altcoin”)

Here are some headline news from 2018

• By Oct 2018, Fidelity launched Fidelity Digital Assets. Fidelity recognized the demand from the institution for this asset class.

• A Goldman-backed startup is launching a crypto pegged to the dollar — part of plans to ‘rebuild the financial system on top of crypto’ .Cryptocurrency company Circle (Goldman backed) is becoming the first issuer of USDC, a new crypto “stablecoin” it helped develop.

• Russia introduced the Crypto-Ruble in 2018 and Putin supports Russia’s involvement with the world of cryptocurrencies.

• Goldman Sachs back payment company, Circle buys cryptocurrency exchange Poloniex 2018 Headline news from 2019

• US investment bank JP Morgan has created a crypto-currency to help settle payments between clients in its wholesale payments business.

• JPM Coin is the first digital currency to be backed by a major US bank.

• Bakkt has won approval from US regulators to trade physically-settled bitcoin futures, a move many believe would legitimize the cryptocurrency industry before institutional investors.

• Bakkt bitcoin options on futures to launch December 9 Bakkt was launched by ICE which is a parent company of the New York Stock Exchange ( NYSE)

• NASDAQ has launched an index for decentralised finance (DeFi), called Defix (DEFX)

Headline news from 2020

• China’s central bank says it has completed ‘top-level’ design of digital currency The People’s Bank of China (PBoC), the country’s central bank, has said that the “toplevel” design of its digital currency has been completed.

What do you think about those headline news? Do you see the trend?

The adoption of this new financial ecosystem may be slower in the country in which currency is stable.

On the other hand, the country such as Argentina, where local currency peso is crashing down against the US dollars, bitcoin is popular as an alternative to gold.

In the past, we saw the consolidation of the brokerage business. Decades ago, the trend of the stock trading commission was getting lower,

Traditional brokerage acquired options trading broker as Options trading commission was much higher. Financial service firm knows what is coming in the future and adjust their path accordingly to survive.

Last few years, the big banks and brokerage firms are moving to the cryptocurrency field shows that that firm knows the shift is coming again. We do not know how this transition occurs worldwide.

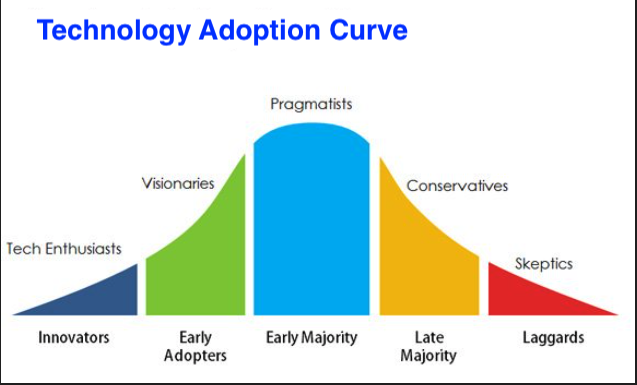

When looking at the Technology Adoption Curve above, we are between late early adopter ( in green) and beginning of Early Majority ( in blue). Most of the people heard of the word Bitcoin, but the majority of people are not utilizing it yet. However, most of the crypto wallet is moving to mobile phones to make the transition smooth. People are addicted to mobile phones, aren’t they?

We discussed Bitcoin as the internet of money, digital currency (IRS called it). Now you may be wondering How about other cryptocurrencies and tokens? Anything useful to have? There are Five thousand tokens if you would like to research them.

To help you save your time and energy, we did our research and showed you the digest of how each token works in Portfolio 3 chapter.

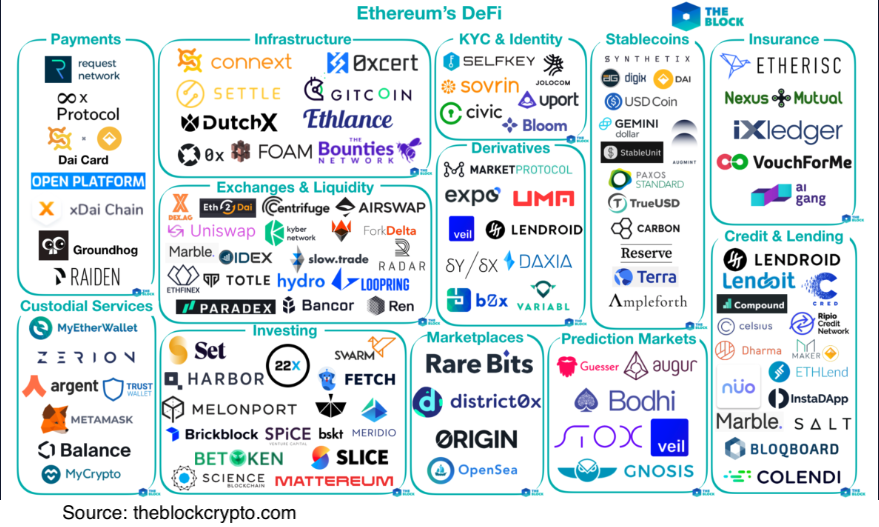

Here, we look at the big picture and talk about Projects called DeFI running on the Ethereum network.

DEFI

What is DeFi?

DeFi is short for Decentralized Finance. There are many projects built on the Ethereum network which offer Financial Service. Most of the people have not heard of DeFi as of early 2020. 2019 was a big year for Defi. Please do not feel bad if you have no idea what that is. Maybe only techy people are excited about it.

It may take several years or decades for us to adopt this system unless a catastrophe happens, and we need to move to a new system fast. But the reality is the new system is already here. DeFi is a series of applications that provide permissionless financial services. For example, instead of going to a bank for loans, you can use Makers Dao to take a loan in DAI stable coin. Also, you can lend your Ethereum to earn interest income.

In the image above, you see industries in boxes: Payments, Custodial Service, Investing, Infrastructure, Exchange & Liquidity, KYC &Identity, Stablecoins, Insurance, Credit& Lending , Marketplace, Derivatives and Prediction Markets.

At this point, we wonder that what happen to New York Stock Exchange or Nasdaq? Will the current system run parallel to these DeFi system? It is easier to imagine, we use stablecoins in leu of dollars to get paid . Volume of Dai, USD coin, PAXOS Standard are traded everyday.

We want to introduce you to the existence of this system rather than showing the details of each project. If you would like to learn further, there are websites dedicated to cover the DeFi area.

DeFi Pulse (https://defipulse.com/)

InstaDapp (https://instadapp.io/)

DeFi Prime (https://defiprime.com/defi-analytics)

MakerScan (https://makerscan.io/)

DeFi Reddit (https://reddit.com/r/ethfinance)

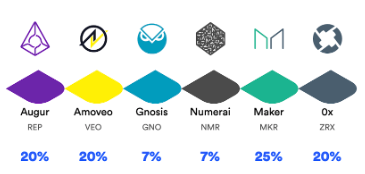

If you want to have a exposure in this area, you can get index of DEFI. Did you know Nasdaq already listed Indexes of these Defi Tokens.?

Defix is one of the Indexes of tokens involves in DeFi system. The image below shows the name of the tokens. Maker is the most know token among these.

Now we move on to getting exposure to cryptocurrency before learning how to buy, store, use Bitcoin, and others. The Dollar has been enjoying the reserve currency status. Russia, China, and Europe are trying to use the no-US Dollar for trade settlement among each other. 2018 China started to use Yuan to pay for oils. The trend to reduce the domination of the Dollar continues to 2020.

What would be the next currency or unit of exchange in the future?

One possibility is going back to the Gold standard. There is a trend of repatriation of Gold since 2014, and also Russia, China has been purchasing a large quantity of Gold.

What do these countries preparing?

The other possibility is setting up new digital currencies. Central bankers are preparing for the shift to digital currencies. There were many talks about cross-border payment using blockchain technologies during The World Economic Forum in 2020. It seems like cryptos are here to stay.