Definition

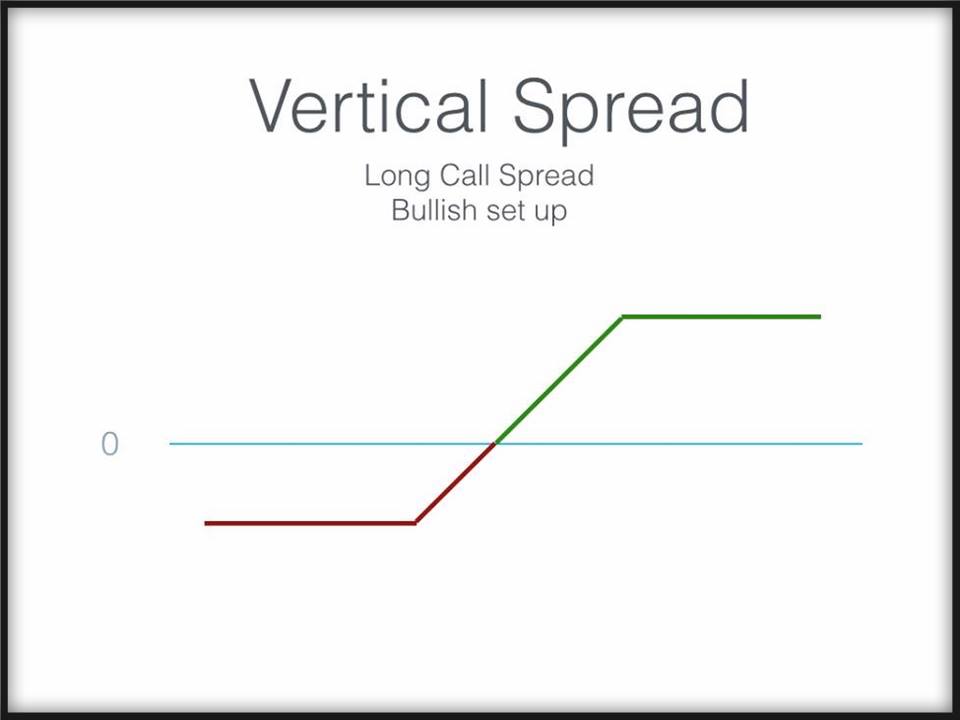

A long vertical spread is the purchase of a call (or put) and the simultaneous sale of a further out-of-the-money call (or put) in the same expiration month.

Vertical spreads are designed for trading in more subdued and normal market conditions. Yes, markets can move quickly and strongly in one direction, but under most circumstances, the markets do not move much from one month to the next. This is where a vertical spread can triumph over a naked option in both risk exposure and return on investment.