Our Books:

All Four Books

Liquid Book

Liquid Book One Strategy for All Markets

One Strategy for All Markets Option Greek for Profit

Option Greek for Profit Options Platinum

Options Platinum

Practicals

Practicals Stock Options and Collars

Stock Options and Collars Time Spreads

Time Spreads

Online Training:

Online Courses: 1-5 Remedial Videos

1-5 Remedial Videos BWB in 3 hours

BWB in 3 hours Collars Mini-Course

Collars Mini-Course Condor Copia Mini Course Recording

Condor Copia Mini Course Recording Online Platinum Class Recording

Online Platinum Class Recording Part-Time Trading Mini Course

Part-Time Trading Mini Course Scalping Class Recording

Scalping Class Recording

Videos & Books:

50/50 Video and Book

50/50 Video and Book Essentials Home Study Kit

Essentials Home Study Kit Practicals Home Study Kit

Practicals Home Study Kit

Live Events: Caribbean Cruise Seminar

Caribbean Cruise Seminar Italy Seminar

Italy Seminar

[/ezcol_1quarter]

Without a doubt, the most common form of investing in America and other countries is buying shares of stock in publicly traded companies. A decade ago, America reached a milestone when the population average had more money in the stock market than equity in their homes. The amazing thing is that the majority of people fear leaving their stove running even with homeowner’s insurance, but don’t think twice about protecting their largest investment – stocks.

In all honesty, we as a country do not do an adequate job informing the public about their opportunity to hedge their stocks. Most Americans don’t even know of the existence of options and their role as a risk management tool. Instead we look to people like Warren Buffet in awe and can’t figure out how he does it, or attribute it to a superior education on the stock market.

Mr. Buffet will likely tell you that he makes as many mistakes as the rest of the world when picking stocks, but he will not mention the advanced hedging techniques he implements to protect his portfolio. So when the world is in turmoil and the markets are falling apart, you see Warren on television with his can of Coke smiling saying, “This is a great time to buy.” Hopefully one day someone reading this will have the same goofy grin and be thanking Random Walk instead of Wharton and Benjamin Graham.

There are essentially three ways to hedge / trade a long stock position:

- Married Put

- Collar

- 5 – Year Millionaire

We will go into the first two strategies which are really the ‘bread and butter” techniques used to hedge stocks and mutual funds. The latter, “5-Year Millionaire”, is a derivative of a collar and is a tad riskier but also has greater expected returns. Because it is complicated, we teach it in our ESSENTIALS class, which is an intermediate curriculum. After that, there are even more advanced methods which can enhance your returns dramatically, but they can take up an entire course in and of themselves.

Request Video of Option Basic Seminar ? Click here

We will start with a married put position since it is the most remedial of all the stock hedging techniques.

Definition

A married put position consists of a long stock position (bullish in nature) that has a long put position (bearish in nature) along as a hedge. It is a long stock and long put position combined, hence the term “married put.”

Married Put = Long Stock + Long Put

Using the option chain from the previous page, we will walk you through an example of a married put and then proceed with criteria.

[ezcol_2third] [/ezcol_2third] [ezcol_1third_end]Let’s say that we start out by buying 100 shares of stock and then buy a put for insurance.[/ezcol_1third_end]

[/ezcol_2third] [ezcol_1third_end]Let’s say that we start out by buying 100 shares of stock and then buy a put for insurance.[/ezcol_1third_end]

Married Put Mechanics

Once the married put is placed, you want the stock to move higher, but the stock can do three things. It can move higher, remain constant, or move lower. Unless the stock moves higher by an amount greater than the cost of the insurance, you will lose money.

This is akin to owning a home. Suppose that you own a $200,000 home and the home appreciates by $2,000 that year (1%). You may feel like it was a disappointing amount of appreciation, but at least you made money. Then when you realize you paid $3,000 for homeowner’s insurance that year, you will grasp that you actually lost $1,000 that year ($2,000 profit on appreciation – $3,000 insurance). To actually make a profit on the home, you need the home to appreciate more than the cost of insurance. This is true for a married put with stock position as well.

Formula

[ezcol_2third] [/ezcol_2third] [ezcol_1third_end]

[/ezcol_2third] [ezcol_1third_end]

Married Put Break-even = Stock Price + Put Premium

Married Put Break-even = $201 + $2.43 = $203.43

Here you see that the break-even point on this particular position is $203.43, but it is obviously different for each stock and put you choose. In the next chart, we illustrated how the stock and put look combined throughout an extensive range of possible stock prices at expiration.

[/ezcol_1third_end]

Stock Falls

Notice the “net PNL” of the position from $195 per share and lower is capped out at a maximum loss of $843. Once the position is initiated, the position will lose money should the stock sell off, and will not stop losing money until the stock falls to the put strike. Once at the put strike (and lower), the position has lost its maximum value and cannot lose more.

The maximum loss of a married put position could be calculated just as easily as the break-even price.

Maximum Loss = Put strike – stock purchase – put cost

Maximum Loss = $195 – $201 – $2.43 = -$8.43 (per share)

Stock Rises

When initiating a married put position, you want the stock to rise – the higher the better. We saw that the break-even of this particular position was $203.43. Anything beyond that price to the upside on expiration is a profit. You make more money as the stock goes the higher because the whole price of the put insurance has been paid for already, and nothing else is left to hold this back from making more money.

Stock Stays Flat

You see the Net PNL of the stock price $201 is Loss of $243. Stock price remained same thus you did not make money on stocks. Loss of $243 is the result of the insurance Put option expired worthless.

Combined (Synthetics)

We saw what happened as the stock moved higher, stayed flat, and sold off. We examined how nothing else could be lost once the stock fell below the put strike price, and the position just rested at its maximum loss. Yet as the stock ran higher beyond the break-even point, we could theoretically make an unlimited amount of money. This is an interesting position and the beginning of what is known as “synthetics”.

This long stock and long put position now act exactly like a long call even though there are no calls in this particular position. The profit and loss graph compares this to a call purchased for $8.43. In other words, the first graph shows the married put while the second graph shows a 195 strike call purchased for $8.43.

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]Synthetics are well beyond the scope of a basics course, but we will mention that whenever you trade two different instruments you will usually be creating a synthetic. In this text, we will be dealing with 3 investment tools – an underlying (stock, future, index, commodity, etc.), a call, and a put. When using two of the three tools, you will usually end up creating the third. We saw how a put and stock can create a synthetic call.[/ezcol_1half_end]Figure 9.6 is a guide to show what possible combinations exist. Do NOT get hung up on learning this. This is provided simply to satisfy your intellectual curiosity, but is beyond any basics class.

[/ezcol_1half] [ezcol_1half_end]Synthetics are well beyond the scope of a basics course, but we will mention that whenever you trade two different instruments you will usually be creating a synthetic. In this text, we will be dealing with 3 investment tools – an underlying (stock, future, index, commodity, etc.), a call, and a put. When using two of the three tools, you will usually end up creating the third. We saw how a put and stock can create a synthetic call.[/ezcol_1half_end]Figure 9.6 is a guide to show what possible combinations exist. Do NOT get hung up on learning this. This is provided simply to satisfy your intellectual curiosity, but is beyond any basics class.

Request Video of Option Basic Seminar ? Click here

Once you understand your stock and how the options are priced, you have to determine if buying a married put is too expensive. Given the additional burden the cost of the put places on the performance of the stock, is it realistic that the stock can move up enough in the given time until expiration to offset the cost of the insurance?

In the example we are using, we saw that the stock started at $201 and had a break-even of $203.43. This is only $2.43 higher than the current price of the stock, but for some stocks a $2.43 move up in a month may be difficult or even unrealistic. Other stocks can move that amount in the course of an hour, while some stocks can’t make that much of a move in a month or two. So if the stock only has a realistic chance of moving $2 between now and the time remaining until expiration (based on recent performance), the cost of the put is going to impede the chance of successfully making money.

The chart below shows the stock at a total range from a high to low over 3 periods of 1 month each:

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]

- Month 1 = ($32.75 – $31.50) = $1.25

- Month 2 = ($32.40 – $30.40) = $2.00

- Month 3 = ($32.10 – $29.10) = $3.00 (Earnings Month)

[/ezcol_1half_end]

Stock Range Analysis

What you see in Figure 9.7 is an example where, if we had to pay $2.43 for a protective put, we would be throwing away money as the stock only moved enough to pay for the $2.43 put investment in the last of the 3 months. To compound the issue, the third month was an earnings period for the stock, a time of historically higher stock movement than usual.

Since earnings only come out once every three months, our current month (month 4 which has not traded yet) will likely be less volatile and more like the first and second month. So now a decision has to be made. Do we go with the stock unhedged, hedge it and expect a loss, or do something different?

Thankfully there is a fourth option which is the next strategy – Collars. This will be covered in the next section. In the meantime, there are great times to trade a married put (which will be covered in the criteria portion of the text shortly). Before that, we will show how a married put order may be placed.

There are three common methods to placing a married put order:

- Buying a put to an existing stock position

- Placing the trade as a package

- Placing the trade as two separate orders

A. Buying a put to an existing stock position

Many people have a stock position and don’t realize until years later that options exist. Once they find out that there is a better way to trade than buying and hoping, they will then start hedging the position. So they may have owned shares of stock for years before they started protecting the position with put options.

Still others try to time the purchase of their put hedge. When the market is running up they will leave the stock to be off on its own. Then at the first signs that the market is looking vulnerable, they will run online and hedge their stock with a put purchase. After the stock drops precipitously and the put protection did as was intended, they will sell the put out and wait for a bounce in the market before proceeding again.

B. Placing the trade as a package

Many people prefer to not be without a hedged at any moment and will enter the long stock and long put trade together as a package. This ensures that you will be filled on one side of the trade but not the other, left chasing the losing side down like a newspaper on a windy day.

Placing the order as two pieces is not a bad idea but you will likely place an order for stock at one time and then place an order to buy the put a second later. Once both orders are in, the stock is destined to do one of two things – move up or move down. If the stock moves down, you will obviously be filled on the stock portion of the trade as people will want to sell you the shares. Once this happens, the put will go up in value but you didn’t buy it yet, so now you have to raise your price to be more competitive in the markets. If you are not fast, or if the stock starts to fall fast, you may keep chasing the puts in a game of leap-frog. This can happen in reverse as well should the stock move up and you get filled on the put first.

Package

This is why many people would prefer to place an order as a package. They know they cannot get filled on one piece of the married put without getting filled on the whole position. The position will be placed where the price of the stock and the price of the put are added to each other to come up with a total limit price.

Using the example we have been consistently staying with (by design), we will look at the components of placing a married put as a package. We will be buying 100 shares of stock at a price of $201 per share. In addition, we will be buying the 195 strike put for $2.43. When you add the cost of both of these positions together you get a net debit of $203.43. By placing an order for this amount as a package, you know that you will not have to pay a penny more than this, and you will avoid having to chase the stock or the put while the other is in position.

Even if the stock moves, the position cannot go against you the moment you place the order and it is often easier to get filled. Remember that you will be dealing with one bullish position (the long stock) and one bearish position (the long put). These two counter delta positions help to offset one another and minimize the effect of the market price moving once the trade is placed.

Placing a married put as a package may look as Figure 9.8:

C. Placing the trade as two separate orders

This is much like what was explained in Part A, but by design. Some people like to place the trade as two separate orders, taking a small “leg” in an attempt to get a slightly better price.

A “leg” is when you are trying to place a package in pieces, rather than as a whole, in an attempt to get a better price. This is explained in more detail in chapter 10 “Shaving the Bid-f Spread.”

We saw how the married put did a great job protecting us in the event that the stock fell hard. We also saw that if the stock moves up hard, the married put works well also. The problem is what happens under most circumstances when the market isn’t going crazy.

Under most situations, the markets do not go crazy from month-to-month, rather it is a slow steady wave of small advances and retrenching. Going back to the table and chart in the married put portion, it is easy to see how a married put can be doubly painful at times. Should the stock slightly sell off, you will lose money on the shares you own. In addition, if losing on the stock is not bad enough, the put you spent good money on is decaying slowly every day.

Selling a call will allow time decay to work in your favor and will minimize the negative impact of the long put purchased. This is the thinking behind a collar.

Definition

A collar is a bullish stock position that is comprised of long shares of stock, a long protective put, and a call option sold to offset the price of the put.

Collar = Married Put + Short Call

Short Call

We are not introducing the short call to the married put. People often worry about this when they first think about the rights and obligations of a short call, so let’s go through that now.

Going back to the call introductory material, we know that the owner of a call has the right to exchange his call option for actual shares of stock. The seller of the call must deliver those shares to the owner of the call at the strike price. If you bought the 205 strike call, you have the right to buy the stock at $205 any time you like prior to expiration. The seller of the call is obligated to deliver those shares and collects the money from selling stock at $205.

Stock Runs to $230

Now let’s say that the stock runs to $230 a share. The person who bought the right to buy the stock for $205 per share (owner of the 205 call) is looking pretty savvy since he paid only $2.81 for that right (see option chain at beginning of this chapter).

The person who sold that call collected the $2.81 per share when he sold the option, but now has to sell stock at $205. He obviously does not want to sell the stock at $205 when the rest of the world is trading it back and forth at $230. Yet at the time of the trade, it seemed like a smart thing to do since he also has the stock for protection.

Protective Stock

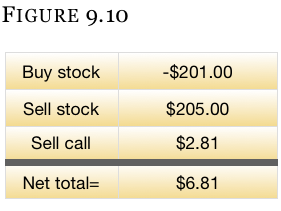

Recall that the collar owner also owns the actual shares of stock he bought for $201 to open the trade. So if he sells the 205 call and the stock is taken away from him at $205 a share, he is not that bad off – especially considering he also received $2.81 in time premium when he sold the call.

Without taking a put into consideration, here is how the math would look:

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]So even though the stock was taken away, you still made $6.81 (3.4%) in one month (not taking the cost of the put into consideration). Keep in mind what will happen to the collar owner who is short a call. He has to deliver stock, but he already owns the stock. The stock that he owns will be sold to the call owner at the strike price and he will be without shares.[/ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]So even though the stock was taken away, you still made $6.81 (3.4%) in one month (not taking the cost of the put into consideration). Keep in mind what will happen to the collar owner who is short a call. He has to deliver stock, but he already owns the stock. The stock that he owns will be sold to the call owner at the strike price and he will be without shares.[/ezcol_1half_end]

Covered Call (long stock + short call)

As a matter of fact, if a put was not purchased, the strategy would be termed a “covered call”. We will discuss the covered call later, but it is essentially the same thing as selling a put naked so not much attention will be placed on this strategy.

Shares Taken Away

Some people panic when their shares are taken away. It is not that big of a deal, especially if the position is in a retirement account. The shares can always be bought back right away. There are no tax issues, since taxes are deferred until it is time to take money from the account. If you are trading this strategy in a regular customer account, there may be tax issues involved, but that is beyond our expertise and is a question for a competent tax specialist.

Figure 9.12 is a graph of the collar position. The call was sold at $2.81, the put was purchased for $2.43, and the stock was purchased for $201. This graph of the collar can get a tad confusing – as more pieces are added to the image, the less they make sense. To help clarify, we lightened out the offsetting pieces of the collar. The remaining portion of the graph that is dark shows how all three pieces of the collar work together as a package.

Why Trade a Collar instead of a Vertical Spread?

Why Trade a Collar instead of a Vertical Spread?

- One

First, you cannot trade a vertical spread in a retirement account at most brokerage firms, but you can trade a long collar.

- Two

Second, some people prefer to own the collar (over a vertical spread) if the stock is paying a dividend. Option holders are not entitled to a dividend like the owners of a stock.

- Three

Third, long term objectives are helpful. In the Platinum Course offered by Random Walk, you will find an alternative way of trading collar positions that allow you to buy a slow decaying hedge (which is what you want) and sell a fast decaying call (which is what you want) to collect time premium quickly. This is an ideal situation for stock ownership.

- Four

Fourth, many people like the Warren Buffet method of trading where stocks are never sold so that you can have a beneficial tax treatment.

Figure 9.13 will help you understand the Math:

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]Ideally, the stock runs a little higher every month and you can keep rolling the calls up a strike, and the puts up a strike. You begin by selling the 210 call, but because the stock runs higher every month, you will be selling the 240 or 250 strike call by the end of the year. You are now making good money on the stock and on the selling of calls. The put you originally bought at the 195 strike is now moved up to the 225 strike, so if the market falls hard, you can always lock in profits at $225. Since you bought the stock for $201, you will be up $24 no matter where the stock falls, while other traders are left to watch a whole year’s returns slip away.[/ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]Ideally, the stock runs a little higher every month and you can keep rolling the calls up a strike, and the puts up a strike. You begin by selling the 210 call, but because the stock runs higher every month, you will be selling the 240 or 250 strike call by the end of the year. You are now making good money on the stock and on the selling of calls. The put you originally bought at the 195 strike is now moved up to the 225 strike, so if the market falls hard, you can always lock in profits at $225. Since you bought the stock for $201, you will be up $24 no matter where the stock falls, while other traders are left to watch a whole year’s returns slip away.[/ezcol_1half_end]

Note:

The chart and the subsequent example is NOT an ideal scenario, nor is it indicative of what you can expect some of the time in a bullish market. It just so happens that this is a stock Random Walk follows closely, and uses as trading examples. It would have worked very well in a collar position.

More importantly, it shows what happens when the stock runs away to the upside and beyond the call strike several times, which is what many people fear. The naysayers of this strategy advocate that the short call limits the amount that can be made in a bullish move of extreme proportions.

While we would agree with them, the important caveat here is the term “extreme proportions”. This is a strategy where you are bullish on the stock, but if you felt that the stock was going to move up 50 -100% in 6 months (which is the time period depicted below), there are other more advanced and less risky strategies available. This is not a class on finding the best trade in hindsight (after you know what the stock did) – we teach how basic option strategies work and what can be done in a retirement account to protect your life’s savings.

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]Figure 9.14 is a 6 month chart of a popular stock. As you can see from first glance, the stock ran up high and fast from February through April, only to start giving back some gains into mid-April and mid-May. As stated above, it would take us perhaps 20 minutes to find a trade that, in hindsight, would make this strategy look like you would be a multimillionaire in months. We chose to paint a more realistic picture of what one can expect, while at the same time showing that the stock going through the call strike is not an emergency or anything to fear.[/ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]Figure 9.14 is a 6 month chart of a popular stock. As you can see from first glance, the stock ran up high and fast from February through April, only to start giving back some gains into mid-April and mid-May. As stated above, it would take us perhaps 20 minutes to find a trade that, in hindsight, would make this strategy look like you would be a multimillionaire in months. We chose to paint a more realistic picture of what one can expect, while at the same time showing that the stock going through the call strike is not an emergency or anything to fear.[/ezcol_1half_end]

Early Exercise

Time calls in equities TYPICALLY only get exercised (where you would have to sell out your shares) right before the stock pays a dividend. Otherwise, you will most likely be buying a call back on expiration day if it is in-the-money, or letting it expire worthless if it is out-of-the-money.

Figure 9.15 is an explanation of how we could continuously hedge this stock as it moves through the course of 6 months of trading.

The chart is broken down into time periods. You will notice that this strategy example is only traded once when it is opened, and then at expiration day of every month.

- T1

Here the trade is initiated, but it was not done at any specific time. It could have been weeks or months earlier or later. Timing is nice and helpful with a collar position, but not as important as if you were simply buying stock and holding.

The stock was purchased for $387.93. Immediately, a call was sold and a put purchased, both roughly the same distance out-of-the-money from the stock. Notice that the price of the call sold ($5.15) and the price of the put purchased (-$4.40) was within $0.75 of each other. This is an indication that the strikes are relatively close in their spacing away from being at-the-money. The call was $37.03 away from the stock (425 strike – $387.93 stock price), and the put was $42.93 away from the stock ($387.93 stock – $345). This is a new difference of $5.90 ($42.93-$37.03), or about one strike price separation.

You will not always get it perfectly separated (say exactly $20 apart each) because the stock was not at an even price when you first entered the trade, because of the bid-ask spread, or because of any other number of reasons.

If you wanted to place this trade as a package, you will avoid getting whip-sawed on three different pieces, and it will help in shaving some of the bid-ask spread.

Order Entry

The order is placed just like any other electronic order, and each broker’s trading platform varies. Below is a general idea of how many of the trading platforms roughly appear. To enter the order, simply add up all the credits and debits to come up with a final price you want to pay. The purchase of a stock is a debit since money is going out and an asset is going into your account. The purchase of a put is also a debit, but when you sell a call, you will receive a credit. Thus buying the stock for -$387.93 and buying a put for -$4.40 will be a total debit of $392.33, but then the call credit of $5.15 brings the total cost/debit down to $387.18. See Figure 9.16.

- T2

There is NOT a second time period. This was purposely omitted to illustrate that we started the trade on Dec 1. T2 should be December expiration. But because we went in and did the January options right from the start (2 month out options), an entire expiration went by and we didn’t have to do a thing until the second expiration on Jan 20.

- T3

Time 3 is January 20th and an expiration date. Because the options we originally traded back on December 1 are expiring today, we have to close them out or let them expire worthless. After that we will put on a new collar to re-hedge the stock that would not have any protection unless we did something.

Important

Make sure that you understand the process in this time period as every subsequent time period will be almost exactly the same.

- T4

We need to look at the fourth time period, especially if you are concerned about what happens when the stock runs through the call that started OTM, but is now deep in-the-money. In the previous time period we sold the February 460 strike call and the stock ran all the way up to $502.12. This means that the 460 call is now $42.12 in-the-money, and we did not profit by all the extra movement above the strike price. It is at this time that many traders will be kicking themselves for having sold the call.

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]Do NOT let this bother you. You will notice here that we did cap our profits and lost out on $42.12 of advancement in the share price. As a matter of fact, the same thing happened in the next time period as well (see the chart above) where we could have made an additional $15.15 on the stock price (T5) had we not sold the call. We gave up a total loss of $57.27 by selling the two calls.[/ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]Do NOT let this bother you. You will notice here that we did cap our profits and lost out on $42.12 of advancement in the share price. As a matter of fact, the same thing happened in the next time period as well (see the chart above) where we could have made an additional $15.15 on the stock price (T5) had we not sold the call. We gave up a total loss of $57.27 by selling the two calls.[/ezcol_1half_end]

But when you look at the bottom of the table, you will notice that the total loss on all the calls was equivalent to -$3.66 and -$20.65 on the puts, or about half of what we were whining about when we noticed what happened to the calls we sold. How does the math add up like that? We will see in “time period 7” (T7) that the stock sold off and we made much of the loss from the short calls back on the long puts.

- T5

The stock is advancing so much that the March 570 call sold (in T4) went in-the-money by $15.15 and had to be bought back at a loss in order to avoid having the stock taken away. Again, this is not that big of a deal in the grand scheme of things.

Once the call is bought back and the put expires worthless, we simply continue with our original game plan. Sell a new call and buy a new put.

- T6

Again, T6 is a repeat of previous time periods. The stock moved, and the options are about to expire. We close out the options that are expiring and place new options strategically. In this instance the new options are going to be selling the May 590 call and buying the May 565 put.

We, therefore, tightened up the call and the put strikes closer to the share price. After the huge run higher, we might have we wanted to lock in the profits while the stock was hovering near $600, but staying below it.

- T7

May 18th. Something surprising happened this month – the stock actually went down. Until now, we kept getting frustrated by the stock advancing, even though it was a good thing. Now the stock is declining and we are starting to miss the days that moving higher was frustrating.

From April 20 to May 18, the stock managed to decline from $572.98 to $530.12. This is why we have a protective put on in position; we never know when or where a sell-off will come. By owning the 565 put we are allowed to capture any stock movement below the strike price. Since the stock fell all the way to $530.12, this means that the put was 34.88 in-the-money. We collect this intrinsic value when we sell the put out, and it helps offset the loss from the stock decline.

The important thing to remember here is that we had no idea that the stock would run from $387.93 to briefly over the $600 range when we placed this trade. That is over a 50% increase in 6 months, which is very rare. In addition, we simply traded this position on expiration days only, thus the highest strike put we ever purchased was at the 565 strike. When the stock hit a high of $636 a proactive trader would likely have adjusted his puts higher to lock in more of his stock profits.

For example, should the stock run as high as $636 and the best protection you have on is the 565 put, common sense would tell you to roll it up. The stock can fall from $636 to $565 for a total loss of $71, before the put starts to add protection. It is ludicrous to let that much stock appreciation get away. Yet this example was NOT meant to show how much could be made if we did everything perfectly.

Had we rolled out the $565 puts up to the $615 strike puts, we would have seen a put intrinsic value of $84.88 instead of $34.88 in T7. In other words, we missed out on $50 of profit on the way down.

Again, this example is not to illustrate what the trade would look like if things were done perfectly, or even proactively. It is to illustrate the concept behind the trade, to show what things look like should the stock run through the call strikes, and to show what happens when the position is only managed 1 day a month.

Request Video of Option Basic Seminar ? Click here

As we briefly explained before, a covered call is the simultaneous purchase of stock and sale of a call option. Many people trade this strategy looking to enhance their stock returns. The thinking is that, as long as you are buying stock anyway, why not sell a call that is likely to go out worthless? Perhaps you will make more money along the way and have a small amount of protection.

Definition

By definition, a covered call is the simultaneous purchase of stock shares and the sale of a call option, usually done slightly out-of-the-money.

We know that the 210 strike call is trading for $1.33, so why not sell it since we are protected by the long shares of stock? Many will be satisfied with the return if the stock gets up to $210 from $201 in a month or two.

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]A $9 move is a 4.3% return in a short period of time ($9/$201 = 0.0428). But this move usually does not happen with this stock. The stock may move $9 from a high to a low in any given month, but it seldom moves straight up, so why not sell something that will usually be touched by the stock under normal circumstances?[/ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]A $9 move is a 4.3% return in a short period of time ($9/$201 = 0.0428). But this move usually does not happen with this stock. The stock may move $9 from a high to a low in any given month, but it seldom moves straight up, so why not sell something that will usually be touched by the stock under normal circumstances?[/ezcol_1half_end]

So the trader/investor will sell the 210 strike call (or any strike they feel is safe) and hope to keep generating a positive monthly cash flow. By taking in $1.33 every month on average, you can make an additional $15.96 per year (12 months X $1.33) which equates to an almost 8% return on the call sales alone.

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]Ideally, you want something similar to a collar position, where the stock runs a little higher every month and you can keep rolling the calls up a strike. You begin by selling the 210 call, but because the stock runs higher every month, you will be selling the 240 or 250 strike call by the end of the year. You are now making good money on the stock and on the selling of calls.[/ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]Ideally, you want something similar to a collar position, where the stock runs a little higher every month and you can keep rolling the calls up a strike. You begin by selling the 210 call, but because the stock runs higher every month, you will be selling the 240 or 250 strike call by the end of the year. You are now making good money on the stock and on the selling of calls.[/ezcol_1half_end]

What you see here is a stock that runs up to, but not above, the strike price of the call sold. This is what we want. In Month 1 the stock ran up to $209 on expiration, so the 210 call sold expired worthless. But because the stock is now higher, we can sell a higher strike call the following month.

At the end of the four months of trading, we made $39 on the stock and $5.33 on the calls. Even on 1 contract, the calls added a $533 profit to the trade.

We briefly discussed the problem with a covered call position. It will further be elaborated as covered call is the same as synthetic naked put. Interestingly enough, you will still find a majority of brokers who do not allow people to sell naked puts. At first, they tell their clients, “it is too risky for our standards,” but they will come back later and say, “Instead of selling puts, why don’t you do a covered call if you want to trade options? They are safer.”

But they are not riskier – they are the exact same thing.

How This Makes Sense

You will recall that any two tools can create the third tool as shown in the table below. A long stock and short call position creates a short synthetic put.

Because we are dealing with an out-of-the-money call being sold, the synthetic short put will be at the strike price of the call – 210. So when we buy stock for $201 and sell the 210 call, we are in fact selling a synthetic 210 put to open. Because the call is $9 out-of-the-money when we are looking to sell it, the 210 put would be $9 in-the-money.

Synthetic Put Price

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]

[/ezcol_1half] [ezcol_1half_end]

The synthetic put will be priced at the intrinsic value of the put strike (210 strike), which is $9 in this example, PLUS the premium of the call sold, which was $1.33. So if we buy stock for $201 and sell the 210 call at $1.33, this is the same thing as selling the 210 put at $10.33 ($1.33 call premium + $9 intrinsic value).

Figure 9.22 is the graph of a covered call position compared to the sale of the 210 put at $10.33. Notice that the net profit and loss of the covered call and the naked put sale are exactly the same! And as a matter of fact, no matter what price you come up with on the stock, the covered call will have the same profit and loss and the naked put sale.

So when would a covered call make sense to trade? Any time you think that selling a naked put would be profitable.

[/ezcol_1half_end]

As you can see in Figure 9.23 option chain we have been using throughout the text, the 210 put is trading at $10.15 bid – $10.35 ask, right in the range of where the covered call predicted it would be.

Figure 9.24 graph shows the covered call in dark lines and a synthetic put position in faded colors so that you can get an idea of how the two positions compare.

In this section, we illustrated the most common stock hedging strategies – Married Put, Collar, and Covered Call. You have seen the strengths and weaknesses of each of the three strategies and are probably wondering which is best for you.

This depends a lot on your personality and trading style. Some people are bolder than others. Some people fear a crash every day. Others are more scientific and allow the statistics to decide. A whole textbook could be written on each one of the three hedges and their best scenarios. There are so many variables that come into play, including your own goals, risk tolerances, and personality. To make a blanket statement that a collar or married put is the better strategy for you would be doing you a disservice as this is really an individual preference.

If you believe that statistics and potential objective profitability is the most important thing, then each of these strategies will have their own time and place. Below are some criteria that will help you pick the most appropriate strategy according to your own unique concerns.

To help you read the chart, let’s use implied volatility in the options as an example. We saw how volatility changes dramatically as the market fluctuates and news comes into play. If we simply go off of statistics, then buying options on a high volatility without offsetting the purchase of that vega (through a sale of an option) can be very frustrating. Volatility always (historically) reverts back to its average price. So if you are buying a put to protect a stock (married put) on a high volatility, you may suffer a significant loss and not know why when the volatility collapses. Therefore, when volatility is high, the statistically favorable strategy will be a covered call (selling volatility – not buying it) or a collar (if you don’t want downside risk).

For those interested in learning more about the various stock hedging strategies and which is the most appropriate for you, we recommend a small investment in the textbook, Stock, Options and Collars, available on our website. Or simply contact the office and one of our staff will be happy to assist you.

Request Video of Option Basic Seminar ? Click here

[/ezcol_3quarter_end]