- Step 1 – Determine Market / Stock Direction

- Step 2 – Decide Which Direction (If Any) Stock Is Headed

- Step 3 – Decide How Big of a Move You Can Expect

- Step 4 – Choose an Expiration Month

- Step 5 – Pull Up Option Chain

- Step 6 – Decide on Buying a Spread or Selling a Spread

- Step 7 – Decide on the Best Spread

- Step 8 – Consider Margin Requirements

- Step 9 – Determine Contract Size

- Step 10 – Determine the Price at Which You Are Willing to Pay/Sell

- Step 11 – Place Order

- Step 12 – Make Sure Trade Is Executed

- Step 13 – Set Profit Goal & Stop Loss (Determine Exit Points)

- Vertical Spread Conclusion

- Practice Questions & Answers

Our Books:

All Four Books

Liquid Book

Liquid Book One Strategy for All Markets

One Strategy for All Markets Option Greek for Profit

Option Greek for Profit Options Platinum

Options Platinum

Practicals

Practicals Stock Options and Collars

Stock Options and Collars Time Spreads

Time Spreads

Online Training:

Online Courses: 1-5 Remedial Videos

1-5 Remedial Videos BWB in 3 hours

BWB in 3 hours Collars Mini-Course

Collars Mini-Course Condor Copia Mini Course Recording

Condor Copia Mini Course Recording Online Platinum Class Recording

Online Platinum Class Recording Part-Time Trading Mini Course

Part-Time Trading Mini Course Scalping Class Recording

Scalping Class Recording

Videos & Books:

50/50 Video and Book

50/50 Video and Book Essentials Home Study Kit

Essentials Home Study Kit Practicals Home Study Kit

Practicals Home Study Kit

Live Events: Caribbean Cruise Seminar

Caribbean Cruise Seminar Italy Seminar

Italy Seminar

[/ezcol_1quarter]

Disclaimer

None of the criteria mentioned is meant as investment advice. The purpose of the criteria is to give the reader insight into how some market-makers/traders on the exchange floors scan for potential winning trades while eliminating candidates that do not present an advantage to entering a trade. This is by no means the most complete method of looking for vertical candidates – it is just an introduction to vertical spreads.

In addition, no amount of research, skill, and technical knowledge will ever guarantee success. Most floor traders will admit that about half of their trades are losing positions, and they only made money when they learned to cut their losses and let their winners run (the reverse of how the public often trades). The following information is for educational purposes only and is NOT meant to replace the advice of a sound financial and tax professional. Past success is not a promise of future success. Our attorneys told us to put something else in here, but we forgot what it was – we are retired traders, not lawyers.

Request Video of Option Basic Seminar ? Click here

Whether you have one or not, or whether you realize it or not, you will be making a directional bet by design or by default. Many people will sell verticals (for example) when they have no opinion on the markets and they simply want to try capturing the premium collected. Yet this is an opinion since you are saying, “I don’t think the market will move against me.”

The easiest way of choosing a vertical spread is if you already have an opinion on the direction of a stock or the market. If you do not have one, you can choose a neutral position (selling out-of-the-money verticals). News, charts, earnings coming up, a strong trend, etc. are all good ways to formulate an opinion. If you do have an opinion, go to the next step.

Yet, if you do not have an opinion, it is often best not to trade and wait until you decide.

This step is usually a formality since people typically have an opinion about a stock’s direction before even thinking about placing a trade in it. People think, “This stock is going to go up (or down) huge and I want to make money from it.”

After that, the trader will then go into his toolbox of trading strategies to determine which best fits with the move he is anticipating.

Yet there are times when you may be searching through a list of names you hear in the news and become curious about placing a small trade to get a “feel” for the stock. Usually, the first step is to look at a chart of what has happened with that name in the past to determine its future performance.

This can be a tricky proposition for many novice traders. There is a saying on the floors that is very true: “The trend is your friend.” This means the same thing in the stock market as it does in Newtonian physics – “an object in motion tends to stay in motion.” Stocks in a strong up or down trend will typically tend to stay that way until acted on by an outside force like bad (or good) news, earnings, a stock market move, etc.

Yet this is often difficult for new traders to embrace. They feel that by the time they see the trend it is going to end and they will be stuck buying at the top or selling at the bottom. The good news about vertical spreads is that you only have to dodge the bullet one month and then you will usually be fine provided you set the trades up correctly.

Example

Suppose that you bought a $10 call spread for $3.87 per share (as shown in the example illustrating the trade), and the stock ran up high enough for the trade to make its maximum profit for the first month. This means that the profit will be $6.13 per share ($10 spread – $3.87 investment).

You can now go out and buy another $10 call spread for about the same $3.87, and if the stock falls to the point where the spread is worthless, you will still be up money even though you bought the top. As a matter of fact, you could lose two months and be right once and still come out about even.

This is where it pays huge dividends to be realistic and be conservative with your initial opinion.

Figure 8.2, we see a stock in a very bullish trend. In a little more than 4 months, the stock ran from about $400 a share to about $630 a share. This is a 58% increase in 4 months. In other words, the stock would be asking too much, while finding a spread where the stock only had to move up $20 is much more conservative. The same would be true for a bearish and neutral trend, or stocks in a channel.

NOTE: For Sections A and B, we will assume that we are looking at a 200-205($5) vertical call (or put spread). We will be using the same IBM option chain as you’ve seen in previous chapters.

How long do you think it will take for the stock to move at least one or two strike prices?

With a vertical spread you want the spread to expire the moment the stock is through both strike prices.

If you buy a vertical spread and watch the stock move through all the strikes with a lot of time remaining until expiration, you will make money. Yet, you will not have made the most the spread is capable of making as there will still be time value in the spreads.

Say you have 200-205 ($5) vertical spread and the stock runs to $207. The stock is above the 205 strike as you desired, but with a month to go until expiration, no one will want to pay anything near $5 for the spread. Why? No one would pay near $5 for a spread that can only make $5, but still has enough time before expiration to sell back off and possibly expire worthless.

The shorter the amount of time remaining until expiration, the more sensitive a spread is to stock movement, while a spread with a long time remaining until expiration will be less sensitive to stock movement. When first learning spreads, you may naturally think, “I will just buy a spread with 6 months or a year remaining until expiration as this will give me lots of time to be right and for the stock to move.” But this is a mistake.

The vertical spread needs to be chosen with the least amount of time remaining until expiration, but still have enough time for the stock to make the necessary move beyond the strike prices. Ideally you want to the stock to get beyond all the strikes and then expire into cash as soon as possible. This is a difficult thing to time correctly.

Because of this, it is important to time the spread’s time until expiration well. How far out does one buy a vertical spread?

This is, of course, an educated guess at best, but some things can help you narrow it down:

Look at the last few months of the stock movement on a chart and determine how much the stock has moved on average. The next graph shows that it is not a problem for this stock to move 1 or 2 strikes a month.

Below is a trickier case study.

Remember that we will be looking for the spread we are buying to close all the way in-the-money, so we need the stock to at least move from its current price to beyond the furthest out-of-the-money strike. So even if the stock is at $200 and we buy the 200 – 205 call spread (or the 200 – 195 put spread if bearish), the stock needs to move beyond $5 (or one strike). This is why we want to make sure that there is ample movement and err to the conservative side by saying 2 strikes.

- Month 1

Looking at “month 1” you will see that, if we put this trade on when the stock as at $200, the stock did get close to $208 for a $8 move up.

- Month 2

In “month 2” you see that the month was almost over by the time the stock went down to $200 and it never went much higher. In this case we would have likely put the trade on further out in time in an expiration month to give the stock enough time to move.

- Month 3

The same thing occurred in “month 3” as in “month 2.”

Now examine on your own what would have happened if you put the trade on wherever the stock was at the beginning of the month. In other words, you found a call spread that was right near at-the-money, and you did NOT wait for the stock to get to near $200 per share.

Notice how in “month 1” the stock started at about $198. If you put the trade on using the 200-205 strike spread, you did well. You bought the spread for $2.39 and when the stock closed near $206 the spread was worth the maximum amount ($5 as it was a $5 spread). This means that you made a $2.61 profit.

Earnings reports are often a great time to get accelerated stock movement beyond its norm. Because of the fear and uncertainty associated with earnings, volatility usually increases dramatically as their announcement approaches. Then, once earnings come out, the volatility in the options almost always declines.

This is a very dangerous event for naked option buyers. They will often buy an option (or straddle) and see the price of the option increase slightly because volatility is increasing. They get their hopes up and start saying to themselves, “I am making money and earnings are not even out yet. Once earnings come out and the stock moves in my direction I am going to hit a home run.” Then once earnings are announced, the fear and uncertainty of the results are over and volatility is deflated dramatically. The option will them lose a lot of value due to a decline in the greek, “vega.”

Vega

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]This can be very frustrating, dumbfounding, and costly to a new trader. They feel that they are correct and wrong at the same time and want to give up the game. This is why vertical spreads are usually a superior strategy to buying a naked option into earnings. When buying one call (or put) and selling another call (or put) against it, you will be mitigating the vega component of an option.Figure 8.5 graph shows how a vertical spread has very little vega risk when compared to a naked option.[/ezcol_1half_end]On the left side of the graph are two vega prices. One number comes from before earnings are announced (“start”) and the other number comes from after earnings are announced (“end”). The “start” vega is the high volatility that usually proceeds an earnings announcement. The “end” vega is the implied volatility of the options after earnings are announced and things have calmed back down to normal.

Figure 8.6 is the mathematical comparison of the naked long call to the vertical spread after a collapse in volatility. The naked call in this example lost $225, while the buy and sell strikes of the vertical spread help offset the effects of volatility, and the spread only lost $20 from a collapse in vega.

When doing earnings plays, you must use the correct expiration based on when earnings are out. Below is an example of Apple computer’s earnings, something we played very successfully with a “convoluted spread”. Though that particular strategy is well beyond the scope of this material, the lesson we are explaining can be derived from that trade.Earnings Label

[ezcol_1half] [/ezcol_1half] [ezcol_1half_end]You will see the label entitled “Earnings”. This is the price the stock closed that day, and earnings came out a few minutes after the market closed. It is this day that buying a vertical spread with calls to profit from a potential bullish surprise would have made the most sense.

[/ezcol_1half] [ezcol_1half_end]You will see the label entitled “Earnings”. This is the price the stock closed that day, and earnings came out a few minutes after the market closed. It is this day that buying a vertical spread with calls to profit from a potential bullish surprise would have made the most sense.

If you believed that earnings would be better than expected, then buying a spread a few days or weeks before the event didn’t make sense or money. [/ezcol_1half_end]The stock fell in the 2 weeks preceding earnings from about $620 to $560 ($60 lower) on worries that earnings would be poor.

Expiration Label

You will see another label titled “Expiration”.

When we placed our position, it was done in the AAPL weekly options that expired at the end of the week instead of 3 or 4 weeks out. We wanted to play any bounce without having to worry about what would happen to the price of shares a few weeks later.

Earnings came out Tuesday night and the stock opened Wednesday almost $60 higher. But the day after earnings, the stock started to give back some of the gains achieved from the earnings numbers. When the stock closed and the weekly options expired on Friday, the stock was still above $600 per share.

Had we done a vertical spread in this stock on the day of earnings, we may have opted to buy the 570-580 call spread for $3.88 ($11.62/570C & $7.75/580C). All we would need is the stock to close above $580 on expiration and we would make $6.12 per share. The stock did in fact close on Friday at $603.00.

Exp 2 Label

This is the time of the lesson we are explaining. Had we gone into the traditional monthly options with 21 days remaining to expiration, we would have lost money on the trade. Notice that the stock closed at $530.38 on May 18. Our convoluted spread would have had problems, and if you did the 570-580 call spread, you would have had problems. After earnings came out, the fear of future earnings and a drop in the stock market as a whole forced AAPL’s stock to fall about $100.

This is why it is important to pick the expiration cycle at the right time, especially with an earnings play.

Riding a trend and/or channel can also give you insight into how long to go out in time for a vertical spread. If the stock makes a move from one price to another every 1 week, 1 month, or 3 months you can attempt to profit from this movement.

Channel

Some stocks will move in a certain, almost predictable range over a given period of time. Say that you are looking at a chart and notice that the stock keeps vacillating in a range from $104 to $112 every 6 weeks. When on the low end of the range, you could buy a call vertical (say the 105-110 spread). Then when the stock reaches its zenith of around $112, you could then buy a put spread (say the 110-105 spread) to profit from the decline.

Seasonal

Other stocks, and especially commodities (such as corn), tend to have bullish periods of time during the year. One can also attempt to try to take advantage of the seasonality of certain products via a vertical spread.

Expiration Month Summary

Based on news, stock movement earnings reports, and other information, choose the expiration month carefully. You will want to have just enough time for the stock to do what is expected without having a lot of time left over until expiration. Guidelines:

Request Video of Option Basic Seminar ? Click here

In Step #4, we selected the time until expiration to play the stock. This step is where you pull up the option chain for that given expiration cycle and align to the numbers so you can compare buying a spread versus selling a spread.

For example, suppose that you are bullish on IBM and the stock is at $200 a share. You have also chosen to do a spread in an expiration month that has 39 days until expiration because IBM moves very slowly compared to stocks like AAPL, Google, etc.

We know that the option chain (which we have been working with all along) looks as Figure 8.10:

Many people who are good at adding and subtracting in their heads will be content with leaving this as it is. You can save time by pulling another option chain with spread prices and you may find it easier to set the spreads up so that can easily compare spread prices without having to retain the previous spread’s value in their short term memory. Either way you prefer is fine so long it works for you. An example would be as follows:

Example

Because IBM does not move much, we will limit the size of the spread(s) we are looking at to $5 increments. To widen the spread out to $10 or $15 wide would be unrealistic under normal circumstances. Start with the ATM strike and move out.

Since we are looking for a bullish play in this stock, we will price out the call spreads from the 200 strike and up, and then the put spreads from the 200 strike down.

With the call and put spreads in Figure 8.11 and 8.12, you will notice that we have included the amount of risk and reward to the sheet. In addition, we have indicated where the stock needs to close at expiration, and how much of a move it takes to get there. The put spreads have a negative amount under “% Stock has to move” because the stock can sell off a little and still make money. The call spreads on the other hand need to see the stock advance to make money.

This is the most difficult of all of the steps so you should get used to knowing that you will almost always make the wrong decision or have found a better trade in hindsight. That is trading.

Based on your opinion of the stock, news, earnings, the trend of the market as a whole (Dow & S&P500 and NASDAQ), and the recent movement of the stock, determinate if buying a spread or selling a spread makes more sense for you.

Important Considerations

The important thing to remember when you are deciding between buying a call spread (or buying a put spread) and selling a put spread (or selling a call spread) is probabilities. Perhaps the best way for people to understand this is to compare two graphs of the normal distribution curve which show what you need the stock to do.

The odds of the put spread sold going in-the-money is roughly only 39%. This means that it has a 61% chance of expiring worthless – which is what you want. The call spread has a worse probability graph in that it only has a 39% chance of being worth the maximum amount on expiration – yet it has a better risk to reward ratio.

Like in the previous step, this is the most difficult part of trading. You will likely never know which spread was the best until at the end of the month when the game is over. Like a professional baseball coach picking his starting line-up, picking the best spread will always have you second guessing, “What if…..?”

You will need to keep in mind the reality of the stock market and check your emotions. You may be very bullish on a stock and think something like IBM could move from $201 to $225 this month. This will have you wanting to choose a cheaper and further out-of-the-money spread as your risk is lower and your profit could be higher. Yet the probabilities that the stock will get to $225 is far less than it getting to $205.

Choose strikes that have a real possibility of going in-the-money when buying a spread, or strikes that have a decent (not great) chance of going out worthless. If chances are too good for the spread to expire worthless, then you will not receive much money for the trade. You will be tying up a lot of margin for something that cannot make a good deal of money.

Keep in mind the margin on all trades.

Long Spread

The maximum that can be lost on a long spread (call or put) is what is paid for the spread. This will be the margin on the trade. If you buy a spread for $2.00, the most that can be lost on the trade is $2 per share. Since each contract controls 100 shares of stock, this equates to a margin of $200.

Short Spread

When you sell a vertical spread, you take in premium. That premium is frozen. It is NOT yours to keep forever no matter what, despite what some other books or firms say. It is held in the event that you have to give it back.

In addition, whatever else that can be lost on the spread will also be frozen for margin purposes. Thus, if you sell a vertical spread at $1.90 per share, that $1.90 will be frozen. If the spread is $5 wide, it means that you can lose $5 minus the $1.90 you took in – or $3.10. Thus, you will be required to put up $3.10 per share of your own capital to stay short this spread. $3.10 per share is equal to $310 per contract (at 100 shares per contract). Thus your margin on this trade will be $310.

For this reason alone many people prefer to buy long vertical spreads as it gives the appearance of costing less money to get into the trade in margin terms. This is often a faulty way of thinking and not a reason to avoid selling vertical spreads.

When deciding which trade to do, you will need to keep in mind the amount of margin required so you know how many contracts to trade.

When placing trades, remember that you are going to have losing trades. It is part of the game, and the best and most profitable traders in the world have a huge amount of losing trades. In short, you do not want to use up all your capital on one trade.

Sound money management principals should be implemented, but this is the topic for a book all by itself. When first learning to trade options, it makes sense to open a brokerage account that allows paper trades (practice trades) where you can place an imaginary trade and watch the position between its inception and expiration.

Yet there will be a time when you will want to start trading with real money. A good rule of thumb is to never put more than 10% of your risk capital into any one trade. Random Walk has classes that we call POT – Practical Option Trading. These classes are live webinars conducted once a week. In these classes we spend about half of the time teaching new strategies and discussing current market conditions, and the other half of the time placing paper trades to learn the new material. With a $100,000 paper trade account, we seldom have more than $5,000 margin in any given trade. We average 5% per trade.

Given this information, determine how many contracts to trade.

Also keep in mind that you want to start slow and small, and let your profits force your growth – not your ego.

We already learned that each option will have a bid price and an ask price. Vertical spreads will also have a bid and ask price. More information is included in chapter 10, “Shaving Bid-Ask.”

[ezcol_1third] [/ezcol_1third] [ezcol_2third_end]We already covered the bid-ask spread of a stock and a single option in previous chapters. The vertical spread works in the same way.[/ezcol_2third_end]

[/ezcol_1third] [ezcol_2third_end]We already covered the bid-ask spread of a stock and a single option in previous chapters. The vertical spread works in the same way.[/ezcol_2third_end]

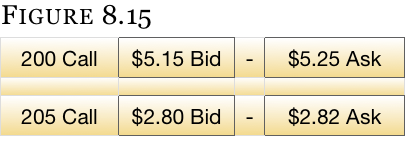

When looking at the 200 strike call, we know that the buyer wants to pay $5.15 and the seller wants to receive $5.25. A compromise will have to be initiated before a trade takes place. Right now it is a stalemate.

If the buyer decides that he doesn’t want to wait any longer and just has to have the calls, he will have to pay up and buy it from the seller at the list price (ask price) of $5.25. The same holds true for the seller who would have to stop trying to sell at $5.25 and just take $5.15.

The same holds true with a spread. If you wanted to buy a spread as individual pieces, you would have to go in and buy the 200 call at the ask price of $5.25, and sell the 205 call at the bid price of $2.80. Thus we can say that the ask price of the spread (the price at which we know people will sell) is $2.45 ($5.25 – $2.80).

If we wanted to sell the spread immediately as individual pieces, we would have to sell the 200 call on the bid at $5.15 and buy the 205 strike call at the ask of $2.82. Thus the bid price of this spread (the price at which people are trying to buy) is $2.33 ($5.15 – $2.82).

We know that the spread has a bid price of $2.33 and an ask price of $2.45. The mid-point of this spread is $2.39 – a price exactly in the middle of the bid price and the ask price. It is most likely that we will have to pay more than the mid-price or sell below the mid-price, but it won’t be quite as bad as the full bid ($2.33) or ask ($2.45) if selling or buying respectively.

A trader who wants to buy this spread may look at the mid-price of this trade of $2.39 and say, “I have to pay more than $2.30 (the mid) but not the full asking price of $2.45. Maybe I will start out with a bid price of $2.41 or $2.42 and see if anyone sells it to me.”

Again, a lot of variables go into the dynamics of where you can buy and sell an option or spread. This is why there is a whole section on just the bid-ask spread and shaving the price to something better than a worst case scenario.

There are two ways to enter an order: verbally or electronically.

How to place an order verbally with a telephone call to your broker:

Using the numbers we have been using in this example so far we would get:

Electronically, if we enter the order electronically, we would get the order entry form similar to Figure 8.18:

Make sure the trade is executed, or filled. There have been many times in most professional trader’s careers where they entered an order at a price that they thought was so aggressive that they certainly had to be filled (meaning the trade was completed). They may not have even double checked to see if the trade was actually filled because they were so certain someone was definitely going to take the other side of the trade.

Then a couple days later, when they saw the stock was doing exactly what they had anticipated, they looked in their account, expecting to see a profit, and were surprised that nothing was there.

The biggest mistake new traders make is not worrying about where to get out of the trade.

Once you execute a trade, you should know where to get out of the position should you make money or begin to lose money. There are a couple of things to keep in mind, and a simple process to go through until you develop your own personal technique.

Remember that a vertical spread can only be worth the maximum at expiration if the stock is through both strikes. When there is more time until expiration with a long call spread, the spread will trade for less because the stock has more opportunity to sell back off. (The opposite is true for a long put spread.)

Thus, you should not plan your profit exit point at the maximum profit that can be made on a trade. But on the other hand, giving you a more optimal number is difficult as well because each stock is slightly different. There are many variables at work, and it becomes a balance between the stock price, volatility, and time remaining until expiration.

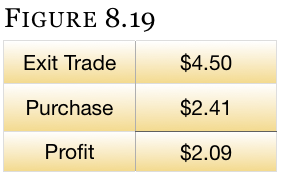

It would be safe to assume that the last $0.50 of every $5 spread is the hardest to make, and really only comes to you as time is very close to expiration and/or the stock has gone dramatically through all the strike prices. Thus, on a $5 spread you would want to get out before it got to $4.50. On a $10 spread it might make sense to get out before it gets to $9, and so on.

[ezcol_1third] [/ezcol_1third] [ezcol_2third_end]

[/ezcol_1third] [ezcol_2third_end]

So if we are buying the call spread in the previous example for $2.41, and getting out at $4.50, we know that we are going to have a profit on the trade (if we do exit at that price) of $2.09 ($4.50 sale price – $2.41 purchase price).[/ezcol_2third_end]

Once you have the profit you are looking to make, finding the loss you are willing to accept is rather straightforward. Simply take half of what you are looking to make and use that number as the maximum loss you are willing to sustain on the trade.

Since we were looking to make $2.09 on this trade, we would be willing to accept a loss of up to half of that, or $1.04. Since the spread was purchased for $2.41 and you are willing to lose $1.04 on the spread, your loss exit point will be $1.37 ($2.41 purchase – $1.04 loss).

There is sound reasoning to support our choices. If we risk no more than $1 to make no less than $2, we can be right 33% of the time and break-even. If we are right half the time, we make good money.

Naturally, there will be some variances you will make to this throughout time. There will be times when the stock is not acting like it normally does and you get scared. This may happen before it hits the profit goal or stop loss. When you are scared, it is time to get out. This will come with experience that cannot be taught in a book. Our technique is also not a sure fire way to profit as it is possible to have five losers in a row without one winner. Winning and losing streaks do occur in trading, and there are better techniques professionals typically prefer to employ. This class is still going to take you beyond the average investor, and even the average options trader. Yet, there are also more profitable and risk averse ways of trading available.

Request Video of Option Basic Seminar ? Click here

As you have seen, a vertical spread can be a powerful strategy in the right situation, and it becomes even more potent when coupled with long and short vertical spreads in strategic combinations. This is why mastering vertical spreads is imperative to anyone wanting to learn advanced option strategies. This material was condensed into the essentials to help you learn faster. We suggest that you re-read this chapter while playing with some paper trades to get a comprehensive feel for the strategy.

[/ezcol_3quarter_end]